- Why Disputes Matter

- Top Tactics to Prevent Chargeback Issues

- Tech Tools to the Rescue: Payment Platforms and Fraud Prevention

- A Conclusion to Mastering Dispute Prevention in Your Restaurant

Welcome to the busy world of restaurants, where the grill is sizzling and customers are smiling.

But to do that, you’ll need some smart tricks to keep your money matters in good shape!

In this article, we’ll tackle practical strategies, like gathering guest feedback, to efficiently manage your finances and avoid chargebacks.

So, let’s get down to business and navigate the world of dispute prevention in the restaurant field.

Why Disputes Matter

In the hustle and bustle of running a restaurant, it’s easy to overlook the payment disputes, better known as chargebacks.

Understanding why disputes matter is the first step in fortifying your establishment against potential pitfalls.

The Financial Ripples

Chargebacks aren’t just a minor hiccup; they can send financial shockwaves through your business.

When a customer disputes a charge, you lose the revenue from that transaction and incur chargeback fees. Multiply this by several instances, and the impact on your bottom line becomes substantial.

Reputation on the Line

Beyond the immediate financial hit, disputes can tarnish the reputation you’ve worked hard to build. Negative chargebacks can lead to unfavorable online reviews and damage your patrons’ trust in your establishment.

In the era of online reviews and social media, a single dispute going viral can have lasting consequences.

Operational Disruption

Resolving disputes takes time and effort. The administrative burden can disrupt your daily operations, from gathering evidence to communicating with payment processors.

An effective dispute prevention strategy avoids financial losses and maintains the smooth flow of your restaurant’s day-to-day affairs.

Legal Ramifications

Ignoring the importance of disputes can lead to legal complications. Failing to address chargebacks promptly and appropriately may result in legal action, adding legal fees to the already mounting costs.

In essence, recognizing the significance of payment disputes is like realizing the importance of a well-organized kitchen – it’s the backbone of your success.

Top Tactics to Prevent Chargeback Issues

Tactic #1: Order Accuracy and Clear Communication

In the culinary world, precision is key, and the same holds true for managing payment disputes.

Ensuring order accuracy and maintaining clear communication with your customers can be a powerful shield against potential chargeback issues.

- Double-Check Orders: Train your staff to pay meticulous attention to customer orders. Accuracy at this stage enhances customer satisfaction and reduces the likelihood of disputes arising from incorrect or incomplete orders.

- Clear Menu Descriptions: Ensure that your menu items have detailed and accurate descriptions. This helps set clear expectations for your customers, reducing the chances of dissatisfaction due to unmet expectations.

- Transparent Policies: Communicate your refund and return policies clearly in-store and for online orders. When customers know what to expect in case of any issues, they are less likely to resort to chargebacks as a first line of action.

Tactic #2: Secure Your Digital Fort: Online Payment Best Practices

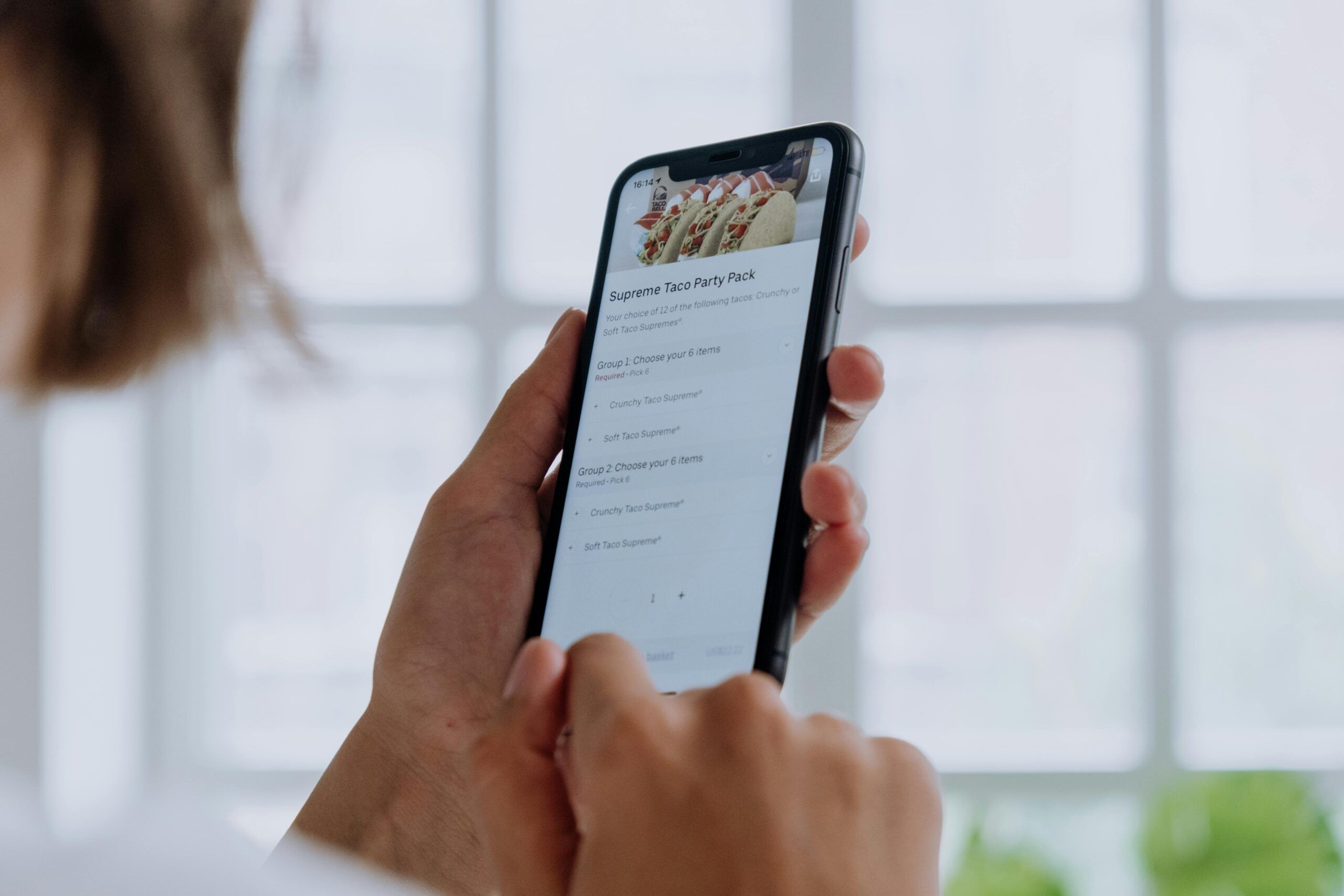

In the age of digital transactions, securing your online ordering payment processes is paramount.

Online payments are susceptible to fraud, and a secure digital fortification protects your restaurant’s financial assets.

- SSL Encryption: Employ Secure Socket Layer (SSL) encryption on your website to safeguard customer information during online transactions. This protects your customers and establishes trust in the security of your digital payment systems.

- PCI Compliance: To maintain a secure payment environment, adhere to Payment Card Industry Data Security Standard (PCI DSS) compliance. This safeguards your customers’ sensitive information and helps you avoid penalties and legal complications.

- Two-Factor Authentication: Implement two-factor authentication for online transactions to add an extra layer of security. This can deter unauthorized access and prevent fraudulent activities.

Tactic #3: Master the Art of Documentation

Documentation is your restaurant’s insurance policy against payment disputes.

Thorough and organized documentation provides a solid foundation for resolving disputes in your favor.

- Digital Receipts: Issue clear and detailed digital receipts for every transaction. Digital records serve as tangible evidence in a dispute and can be easily accessed and shared.

- CCTV Coverage: If applicable, ensure that your establishment has comprehensive CCTV coverage. This visual documentation can be invaluable in resolving disputes by providing a clear timeline of events.

- Employee Training: Train your staff to document relevant information, such as customer interactions, order details, and payment confirmations. Well-documented transactions leave little room for dispute ambiguity.

Tactic #4: The Power of Real-Time Customer Feedback

Harnessing real-time customer feedback is not just a marketing strategy; it’s a powerful tactic in dispute prevention.

You can nip potential issues by encouraging and promptly addressing customer feedback.

- Feedback Platforms: Utilize digital platforms and surveys to gather real-time customer feedback. Promptly address any concerns or grievances, demonstrating your commitment to customer satisfaction.

- Customer Service Training: Train your staff in effective customer service and conflict resolution. A positive and responsive customer service experience can turn a potentially disgruntled customer into a loyal advocate for your business.

Tactic #5: A Seamless Exit: Handling Dissatisfied Guests Gracefully

Only some dining experiences will be flawless, but handling dissatisfied guests can make all the difference in preventing restaurant chargebacks and maintaining customer loyalty.

- Feedback Loop Closure: Close the feedback loop when a customer expresses dissatisfaction. Follow up after the resolution to ensure the customer is satisfied. This extra step shows commitment to customer happiness and allows one to address any lingering concerns.

- Compensation Policies: Consider implementing fair and reasonable compensation policies for legitimate grievances. Offering discounts, complimentary items, or future discounts can turn a negative experience into a positive one, reducing the likelihood of chargebacks or smoothing the chargeback process.

- Rewarding Your Loyal Followers: By creating a loyalty program, you can ensure loyal customers get deserved attention. These groups of people contribute to your restaurant’s lifeline, so it’s essential to reward them in case of disputes through coupons, free giveaways, and “on the house” gestures.

By mastering these tactics, you equip your restaurant with a robust defense against payment disputes, fostering a positive dining experience for your customers while safeguarding your financial well-being.

Your Inbox, Your Rules!

Tailor your newsletter with the topics you're most interested in.

Tech Tools to the Rescue: Payment Platforms and Fraud Prevention

Let’s explore how payment platforms and fraud prevention tools can be your allies in maintaining financial security.

Secure Payment Gateways

These gateways encrypt customer information during online transactions, reducing the risk of sensitive data falling into the wrong hands.

Here are some examples of well-known and trusted payment gateways that are widely used in the industry:

Stripe

Stripe is known for its user-friendly interface, seamless integration capabilities, and a comprehensive set of features. It supports a variety of payment methods, including credit cards and digital wallets. Stripe also offers advanced fraud prevention tools and is popular for its reliability and developer-friendly environment.

Square

Square is recognized for its versatility, catering to both in-person and online transactions. The platform provides a range of hardware options for in-store payments and offers an integrated online payment solution. Square is known for transparent pricing and ease of use.

PayPal

PayPal is a widely recognized and globally accepted payment gateway. It allows a customer to pay using their PayPal account and credit or debit card. With a reputation for security and ease of use, PayPal is a preferred choice for many online businesses.

Authorize.Net

Authorize.Net is renowned for its robust security features, including fraud detection and prevention tools. It supports a variety of payment methods and offers customizable checkout options. Authorize.Net is often chosen by businesses looking for a reliable and secure payment gateway.

Braintree

Braintree, a subsidiary of PayPal, is known for its international payment capabilities. It supports multiple currencies and provides a seamless checkout experience. Braintree is favored by businesses looking to expand globally.

Adyen

Adyen is a global payment solution that supports a wide range of payment methods, including credit cards, digital wallets, and local payment options. It is known for its international reach and ability to handle complex payment processes.

2Checkout (now Verifone)

2Checkout, now part of Verifone, specializes in online payment processing. It supports multiple payment methods and provides a customizable checkout experience. 2Checkout is often chosen by e-commerce businesses for its global payment capabilities.

Fraud Detection Features

Many payment platforms come equipped with built-in fraud detection features.

These tools analyze transaction patterns and flag any unusual or suspicious activities, providing an additional layer of protection against fraudulent transactions.

Here are three widely adopted tools in the realm of fraud detection:

Overview: Forter is a comprehensive fraud prevention platform that leverages artificial intelligence and machine learning to analyze real-time transactions.

It assesses various factors, including user behavior, device fingerprinting, and transaction patterns, to identify and prevent fraudulent activities.

Key Features:

- Real-time fraud detection.

- Behavioral biometrics analysis.

- Integration with e-commerce platforms.

Overview: Kount is a fraud prevention solution that combines artificial intelligence, machine learning, and device fingerprinting to evaluate the risk associated with online transactions.

It offers a range of tools to assess the legitimacy of transactions and mitigate potential fraud.

Key Features:

- Device fingerprinting and identification.

- Transaction risk analysis.

- Customizable rule-based policies.

Sift Science (now part of Digital River)

Overview: Sift Science, now part of Digital River, provides a fraud detection and prevention platform that uses machine learning to analyze patterns and detect anomalies.

It is designed to adapt and evolve with emerging fraud trends, offering a scalable solution for businesses of varying sizes.

Key Features:

- Adaptive machine learning for fraud detection.

- User behavior analysis.

- Real-time risk scoring.

These tools serve as valuable assets for businesses looking to protect themselves and their customers from the evolving landscape of online fraud.

Here are some ways of common fraud detection:

Velocity Checking

How it Works: Velocity checking monitors the frequency and volume of transactions within a specific time frame. Unusually high transaction rates or repetitive actions, such as multiple attempts at payment with different cards, can trigger alerts.

Example: If a customer attempts to make several transactions within a short period or repeatedly enters incorrect payment information, the system may flag the activity for review.

IP Geolocation and Device Fingerprinting

How it Works: By analyzing the geographical location of the user’s IP address and creating a unique fingerprint for their device, this feature helps identify suspicious activities from unfamiliar locations or devices.

Example: The system may prompt additional verification steps if a customer’s payment attempt originates from a different country or is made from a device with no previous history.

Behavioral Biometrics

How it Works: Behavioral biometrics analyze unique user behaviors, such as typing speed, mouse movements, and device orientation. Any significant deviation from the established behavioral profile may trigger fraud alerts.

Example: If a user who typically interacts with the website in a certain way suddenly exhibits erratic mouse movements or keystrokes, the system may suspect fraudulent activity and take preventive measures.

Tokenization

Secure Data Transmission: Implement tokenization to secure sensitive customer data during payment transactions. This process replaces actual card details with a unique token, reducing the risk of data interception and misuse.

Streamlined Processes: Tokenization enhances security and streamlines payment processes, contributing to a smoother and more secure transaction experience for your customers.

By embracing these tech tools, your restaurant can create a digital fortress against potential payment disputes.

A Conclusion to Mastering Dispute Prevention in Your Restaurant

As we finish talking about the ways to protect your restaurant from payment problems, keep in mind that getting orders right, communicating well, and keeping careful records is like building a strong base for your kitchen that can handle issues well.

You’re also making your online payments safe and paying attention to what customers say right away to keep everything secure. When things get tough, handling unhappy customers nicely is crucial for keeping your good name and money.

So, fellow restaurant owners, use these tactics as key parts of your success plan in the restaurant business.