- Why is Proper Restaurant Financial Management Important?

- 9 Data-driven Strategies for Proper Restaurant Financial Management

Unlocking the recipe for restaurant success isn’t just about culinary creativity; it’s also about mastering the art of numbers.

The increase in menu prices in 2023 can strain your customers’ wallets, especially if you offer premium menu items or use expensive food ingredients. That’s why making proper financial decisions is essential for your restaurant’s growth and stability.

In this culinary journey, we delve into the world of data-driven strategies for restaurant financial management.

Discover how harnessing the power of data can transform independent dining establishments into financial powerhouses, where every decision is as delectable as the dishes themselves.

Why is Proper Restaurant Financial Management Important?

Proper restaurant financial management is of paramount importance for several compelling reasons:

Sustainability

Effective financial management ensures a restaurant’s long-term sustainability. A restaurant can weather economic fluctuations and unforeseen challenges by maintaining profitability and managing expenses.

Profit Maximization

It enables restaurants to maximize their profits. By closely monitoring income and expenses, owners can identify key opportunities to increase revenue and decrease costs, ultimately boosting the bottom line.

Resource Allocation

Sound management of restaurant finances helps allocate resources wisely. It ensures that funds are directed toward areas that need investment, such as marketing, staff training/hiring, or equipment upgrades, to enhance overall performance.

And since there’s a worker shortage prevalent in US restaurants, putting some money aside for staff hiring is paramount. You’d want to retain your team members once the season of giving, aka Christmas, approaches.

Debt Management

Restaurants often rely on loans or credit lines for startup costs or expansion. Proper financial management helps manage debt effectively, avoiding excessive interest payments and potential financial strain.

Cash Flow Control

Maintaining a healthy restaurant cash flow is important for daily operations. Proper financial management ensures enough liquidity to cover immediate expenses like payroll, rent, and inventory.

Risk Mitigation

Restaurants face various risks, from food spoilage to market fluctuations. Effective financial management includes risk assessment and mitigation strategies to safeguard against potential losses.

Tax Compliance

Staying on top of financial records ensures accurate tax reporting and compliance. It can lead to significant savings through tax deductions and credits.

Investor and Lender Confidence

If seeking external funding or investors, transparent financial management instills confidence in stakeholders. It demonstrates that the restaurant is a well-managed, low-risk investment.

Data-Driven Decisions

Accurate financial data provides the foundation for informed decision-making. It helps identify trends, customer preferences, and areas for improvement, guiding strategic choices.

Employee Morale

Stable financial management can positively impact staff morale. Employees are more likely to feel secure when they see the business is financially sound and committed to growth.

Customer Experience

Financial stability can enhance the overall customer experience. It provides consistent quality, customer service, and menu offerings, contributing to customer loyalty.

9 Data-driven Strategies for Proper Restaurant Financial Management

Proper financial management is crucial for the success of any restaurant business. Data-driven strategies can help restaurant owners and managers make better and more informed decisions and optimize their financial performance.

Here are nine data-driven strategies for proper restaurant financial management:

Sales Analysis

Utilize data analytics to track daily, weekly, and monthly sales trends. This data can help you identify peak hours, popular menu items, and seasonal variations in sales.

Menu Engineering

Analyze sales data to determine which menu items are the most profitable and which ones may be underperforming. Adjust your menu offerings accordingly to maximize profitability.

Your Inbox, Your Rules!

Tailor your newsletter with the topics you're most interested in.

Inventory Management

Implement inventory management software to track ingredient usage, monitor stock levels, and reduce food wastage. This data can help you optimize purchasing and lower food costs.

Labor Cost Optimization

Use data to schedule staff efficiently based on peak hours and customer traffic. Analyze labor cost data to identify areas where you can reduce labor costs without compromising service quality.

Customer Segmentation

Collect and analyze customer data to identify your target audience and their preferences. Utilize this information to tailor marketing campaigns and promotions effectively.

Expense Tracking

Implement expense tracking software to monitor all operational costs, from rent and utilities to equipment maintenance. This data can help identify areas where cost-saving measures can be implemented.

Tip: If you’ve incorporated online delivery, continuously assess the costs associated with it, including packaging, driver commissions, and marketing expenses. Optimize these costs to ensure that your online ordering and delivery operations remain profitable.

Forecasting and Budgeting

Use historical data to create accurate financial forecasts and budgets. This will help you set realistic financial goals and make informed decisions about pricing, staffing, and other financial aspects.

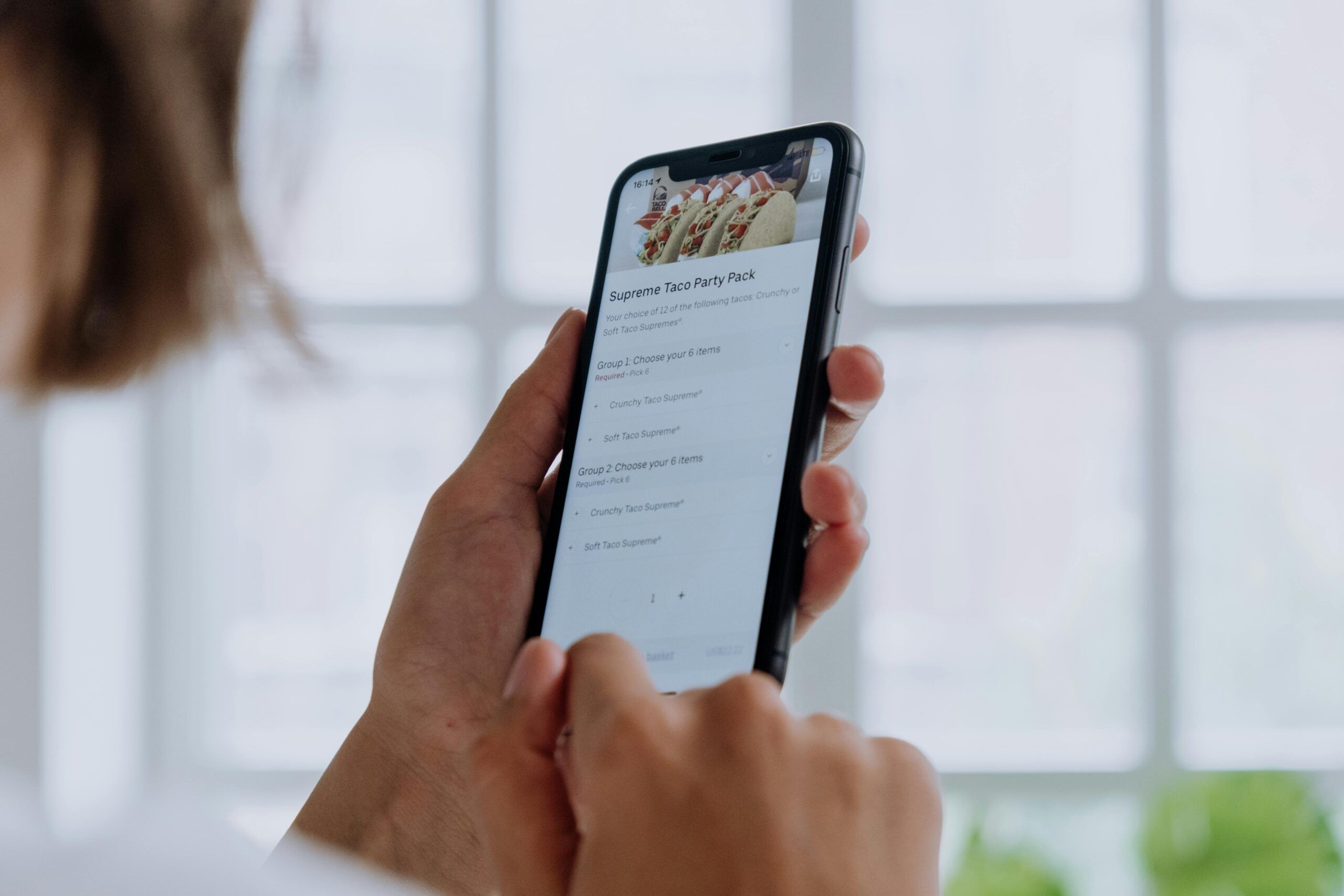

POS (Point of Sale) Analytics

Leverage data from your POS system to gain insights into customer behavior, order patterns, and transaction trends. This can help you make data-driven decisions about menu changes, pricing strategies, and upselling opportunities.

Cash Flow Management

Monitor your cash flow closely by analyzing receivables, payables, and daily sales. Having a clear picture of your cash flow can help you avoid financial crises and plan for future expenses.

Benchmarking

Compare your restaurant’s financial performance with industry benchmarks and competitors. This data-driven comparison can highlight areas where your business may need improvement.

Cost of Goods Sold (COGS) Analysis

Calculate and analyze your COGS regularly to ensure that you are maintaining a healthy profit margin. Identify cost fluctuations and take appropriate actions to control expenses.

Customer Feedback Analysis

Analyze customer reviews and feedback to identify areas of improvement in food quality, service, and overall customer experience. Addressing these issues can positively impact your reputation and revenue.

Fraud Detection

Use data analytics to detect and prevent fraud in your restaurant, such as employee theft or cash register manipulation. Regularly review financial transactions and look for anomalies.

Supplier Negotiation and Vendor Management

Establish strong relationships with suppliers and negotiate favorable terms, such as bulk discounts or extended payment terms.

Regularly review supplier contracts to ensure you get the best deals, and consider exploring alternative suppliers for cost savings. Effective vendor management can significantly impact your restaurant’s bottom line.

Guest Feedback Analysis for Revenue Optimization

Analyze guest feedback and reviews to identify opportunities for revenue optimization.

Respond to customer comments about portion sizes, menu options, and pricing. Use this feedback to make data-driven decisions about menu changes and pricing adjustments that align with customer preferences and maximize revenue.

Maintain Your Restaurant’s Financial Health

Effective financial management is very important for the success and sustainability of your restaurant.

By implementing data-driven strategies, setting clear goals, and continuously monitoring and adapting your financial practices, you can make informed decisions that optimize revenue, control costs, and enhance overall profitability.

Remember that restaurant financial management is an ongoing process, and staying proactive in your approach will help ensure the long-term success of your business in the restaurant industry.